|

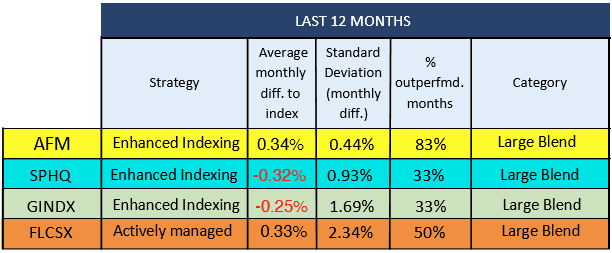

SPHQ - The Invesco S&P 500 Quality ETF is based on the S&P 500 Quality Index. |

GINDX - The Gotham Index Plus Fund was created as an investment that seeks to more closely track an index than purely active funds by combining an index investment with an active long/short overlay. The Fund generally seeks 100% net long exposure by being 190% long vs. 90% short (100% index+ active long/short overlay). The Fund seeks to outperform the S&P500 over most annual periods. The Fund is not a passive index fund.

For each $100 invested in Gotham Index Plus, we start with $100 of U.S. stocks that seek to track the S&P 500® Index. Next, we select long and short positions (from a large cap investment universe) that we believe are the cheapest and most expensive, respectively, relative to our assessment of value. Finally, we net positions that appear in both the index portion and the actively managed long/short overlay, with the result being a portfolio with an overall exposure of approximately $190 long and $90 short.

For the active long/short overlay, the Co-CIOs and their team of equity analysts employ Gotharn’s proprietary analytical framework to evaluate stocks within the coverage universe on measures of absolute and relative value.

FLCSX - Fidelity Large Cap Stock Fund is a diversified domestic equity strategy with a large-cap core orientation.

Normally investing at least 80% of assets in common stocks of companies with large market capitalizations (companies with market capitalizations similar to companies in the Russell 1000 Index or the S&P 500). Investing in either “growth” stocks or “value” stocks or both.